A new approach to negotiating more profitable prices – Pricing Insight

How do you sell products and services at price premiums that are up to 100% higher than your competitors?

The fourth industrial revolution, driven by the Internet of Things, is rapidly transforming companies’ ability to provide substantially more value to customers. Specialized industries such as tele-metric equipment, mining equipment, service and maintenance contractors, and software engineering all provide sophisticated and complex solutions to help customers solve challenging commercial problems—which, if left unsolved, create large economic risks.

Traditional commodity-based industries are also undergoing transformation, as customers seek to consolidate their supply base to simplify operations and reduce costs. However, a new set of challenges is emerging.

A reduced supplier base now means that customers have an increased risk of supply chain failure, if new suppliers are unable to deliver products or services in full and on time. With reduced inventory holdings and contractual commitments to Service Level Agreements at record high levels, margins for error are very small–and the costs of those errors become exponentially higher.

To adapt to this new business landscape, many suppliers have invested in new technology, new processes, or have undertaken substantial research and development to develop sophisticated intellectual property that addresses the increasing demands of customers in a globally competitive business landscape. However, many companies must still set and negotiate the prices for these sophisticated solutions on a cost-plus mark-up basis, which fails to address the value created through productivity increases or risk mitigation.

Cost plus mark-up has been the universal method of price-setting for thousands of years. Many successful companies have built global businesses using cost plus mark-up methods and have provided shareholders with solid returns.

Why is cost plus mark-up an issue for businesses today?

Never before has the world seen such a convergence of globalized markets in conjunction with exponential growth and the rise of new technology solutions across industries. These forces have led to both a reduction in the cost of manufacturing–but also an increase in value provision to customers, as technology-enabled solutions boost productivity and reduce risk.

Companies that still rely on cost-plus pricing methods to compete in this new market are at a disadvantage, when compared with more sophisticated competitors.

The primary flaw with cost-plus mark-up pricing is that many high-volume products or services end up being priced out of the market. Crucial volume that can contribute to fixed cost recoveries is missed—or, critically, value is underpriced for sophisticated products and services that are often regarded as very profitable. In fact, most companies know where to set the prices for their best-selling products because they get daily feedback from multiple customers and are able to benchmark their products against multiple competitors. For companies that have unique products, or complex sophisticated products with few competitors, there is no such feedback. Customers in this scenario fall into two camps: Those who know they are getting a bargain and those who have no idea.

Manufacturers and service providers must define, communicate, and capture value from the market in order to optimise profitability. They cannot wait for the market to advise them on what the correct price levels should be for their products or services.

The economic loss from under-pricing valuable products and services over many years is substantial. If new competitors do enter the market, they have often developed an inferior product which is not a genuine equivalent to your products or services. Your staff often experience great pressure to reduce prices in order to address the competitive threat.

In many cases, the prices of superior products or services are then reduced unnecessarily by management. These price reductions are often driven by fear and not by facts or evidence.

The negative results of these price reductions on premium products can be substantial. Competitors often reduce their initially-low prices to even lower price points. The remaining products in your product portfolio then fall in price, as their price relativities need to be adjusted against the premium products. The result of this aggressive focus on price reduces overall industry profitability and teaches customers to aggressively negotiate on price–at the expense of real value over the longer term.

It can take many years for a company to extract itself from a price war, or re-establish customer relationships that are built on respect for value instead of on price-focused transactional negotiations.

One of the most highly leveraged strategies a Chief Executive Officer can implement to drive profitability and earnings growth is to create a culture of commitment to value-based pricing.

What is value-based pricing?

Value-based pricing is a pricing methodology that is derived from identifying a range of different outcomes that a customer can obtain from your products or services–and then establishing a price that represents some smaller fraction of the total benefits obtained over time. A simple example is a long-life light globe that only needs to be replaced every two years instead of every six months. The light globe provides the customer with four times the value of a regular globe over the two-year period, but is only two times more expensive than a regular globe–thus providing the customer with more value even though they may pay a premium above the price of a regular globe.

But there is more to the value pricing story than just the invoice price comparison for product or service performance. This value pricing example only looks at the tangible or physical properties of the product.

There are five other major fields of value that must be considered when looking to implement a value-based pricing culture into a business.

These five critical fields of value are as follows:

- Transactional value: This value driver addresses the customer’s demand for speed, flexibility, simplicity of buying experience, queueing time, distribution coverage, network service support, and flexibility.

Transactional value can be generated by addressing a customer’s need to access your products or services in very specific ways. A simple example is the way insurance company AAMI has a localized customer service team that will answer a client inquiry immediately and not put customers on hold for 30 to 60 minutes the way many Internet companies currently do.

- Tradeable Value: This value driver relates to how a customer pays for your service and the pricing and revenue model that they will experience. This could include the way you set up your price architecture, with low mid and high price points, or quantity price breaks based on order size, or the way you structure performance rebates, or the way you structure payment terms. As an example, for capital equipment the revenue model could involve an outright purchase, a fully maintained operating lease or casual rental.

- Supply Chain Risk: By far the most important driver of value, and the one value driver that is not well understood by suppliers. Supply chain risk management and mitigation is the Number One area of focus for all procurement managers. Procurement courses across the world teach that continuity of supply is the most crucial factor in determining a supplier. This key fact is not well known by sales staff and rarely marketed or priced into a negotiation. It is, however, your Number One source of pricing power. Think about the value destruction that occurs when electricity cannot be supplied to factories and houses, or when a flight is cancelled during peak holiday season.

- Product/Service Failure Costs: These are the next most important source of pricing power. These occur when the product or service is not fit for purpose or fails to perform after a period of time, either in warranty or out of warranty. Product or service failure can be catastrophic to a customer. There are numerous examples of product or service failure, including the Infinity cables scandal or the Cootes transport disaster, that are all direct results of simplistic invoice price negotiations that failed to identify and acknowledge the full extent of the value exchange that needed to take place.

These disasters cost lives, hundreds of millions of dollars in repairs, and hundreds of jobs. The economic fallout was thousands of times greater than any immediate savings ever made from invoice-price-only negotiations.

Industries with high margins are often characterized by the presence of substantial risks that are known by both seller and customer–and there are significant levels of intellectual property associated with the products and services provided by the seller to address the problems that need to be solved by the customer.

Examples of high margin industries where this is the case are medical technology, software, pharmaceuticals and insolvency accountants. All of these industries have substantial intellectual property components and solve high risk problems for customers. Many suppliers in these industries experience high gross margins and higher than average net profitability after tax. Examples of low margin industries include building materials, paper manufacturers, grocery stores and home furnishing stores.

The irony is that there are substantial amounts of intellectual property and risk associated with these industries as well—yet these elements are often not identified or communicated to customers. Competitors fail to identify these elements, and so the customer becomes a transactional buyer–expecting the prices to be low, and the only source of value extraction to come from playing one supplier off another on invoice price negotiations.

- Technical or innovation support: When something does go wrong, the costs to the customer can be substantial. Downtime per day at a building site could equate to six-figure losses. The value of technical problem-solving support is often under-communicated and not directly linked to the customer’s ability to meet earnings targets or the elimination of earnings uncertainty. When a supplier can clearly articulate their ability to solve problems using a proprietary process that can positively impact their customer’s earnings results, they immediately create further intellectual property assets. These assets can be marketed, and translated directly into price premiums and improved sales profitability.

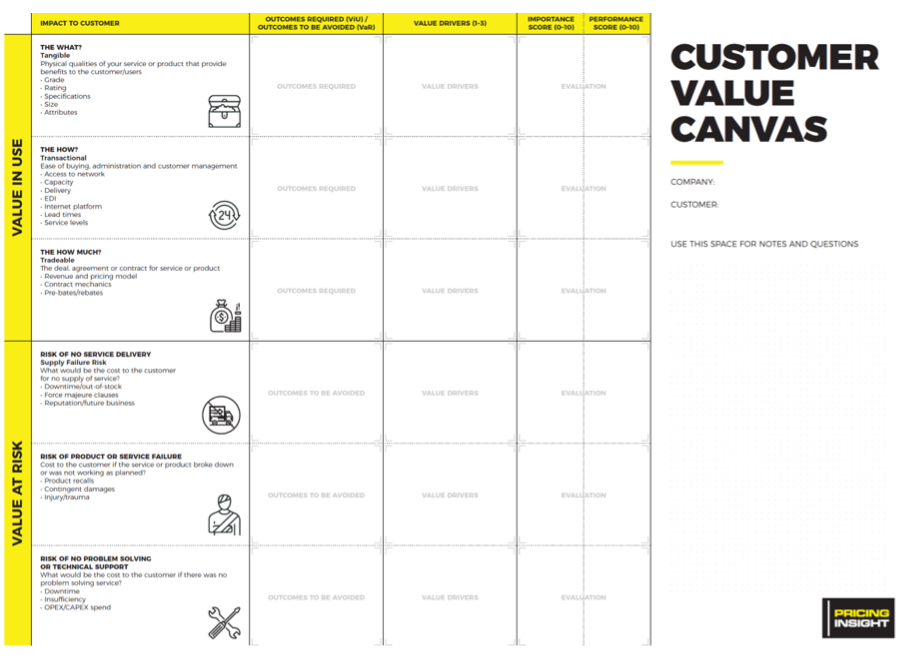

The Customer Value Discovery Canvas

What should be very apparent is that a major source of pricing power comes from the intellectual property that is developed around a product or service. The extent of this increased profitability is a function of how well these IP assets address reduce risk or help customer increase their earnings.

This means that the physical product, which is often described as a commodity, is in fact not a commodity at all. Sales people often believe they are selling commodities; however, they are helping customers find solutions to problems.

There is a substantial opportunity for all companies to identify and market the wider elements of value that are associated with the positive outcomes customers want to achieve–and the negative outcomes they want to avoid.

The solution to finding more pricing power in your business is to develop a menu of value generated by your business model, from which you can select the most salient elements to communicate to each customer.

To build this menu of value, you need to interview your customers to find out their wants. However, these wants must fit with your business model. Too many companies destroy value by trying to create customised solutions that don’t scale, whose costs to deliver exceed the revenue they can generate, and whose customers will often only remain loyal whilst the price remains at levels that create a net transfer of wealth through the supply chain to the customer’s balance sheet.

Through a structured exploration of what creates value in your market, you can start to amplify your communication to the market in the areas where your business excels.

Focused and insightful communication about what creates value to your customer base is the first step to investing in your intellectual property–and to develop assets that customers will then pay price premiums to receive.

More efficient sales outcomes will then be realized as your marketing generates higher quality inbound lead enquiries, which have been shown to have higher conversion ratios and at higher margins than outbound or cold call-style sales generation.

Empower your staff to make more profitable pricing decisions, sell value, and negotiate more effectively using a value-based pricing framework.

Customer Value Discovery will transform your business if you currently use cost plus mark-up methods to set prices. If there is a feeling that your products or services have become commoditized–or alternatively, you have a sophisticated product and are not getting the prices you think you should—this method can also help.

Click here to download the whitepaper.